How BNPL for B2B can boost your SaaS Sales

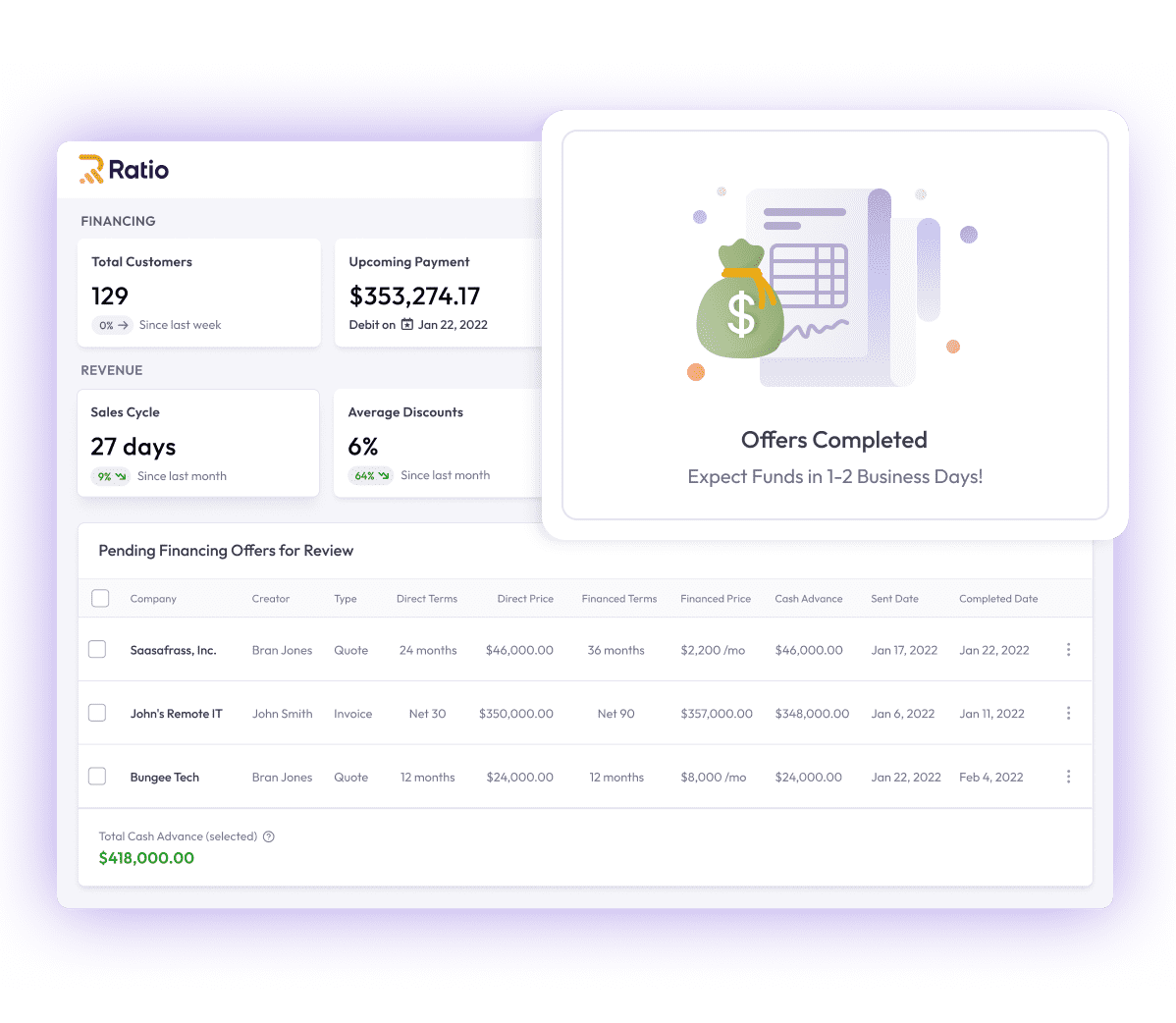

Discover how BNPL (Buy Now, Pay Later) for B2B transforms the financial landscape for SaaS companies. By offering customers flexible payment installments, BNPL solutions not only enhance cash flow but also simplify the quote-to-cash journey, significantly reducing the time spent on credit checks and fraud screening. This accelerates deal closures and increases total contract value (TCV).

Overcoming Sales Term Barriers

Overcoming Sales Term Barriers

BNPL for B2B is a game-changer for closing high-value contracts swiftly, enhancing conversion rates and fostering rapid growth. It introduces unparalleled flexibility in payment options tailored to buyers’ needs while ensuring SaaS providers receive upfront cash for full contract values. Traditional financing options like credit cards often pose limitations for small to mid-sized businesses due to caps or inaccessibility. BNPL addresses this gap by providing short-term, low or no-interest financing, empowering these companies to fulfill their purchasing goals without the burden of interest, thereby elevating the customer lifetime value (LCV) and augmenting revenue streams.

Leveraging BNPL for Liability Management

BNPL stands out by allowing SaaS vendors to swiftly finalize high-value contracts with reduced friction, lowering customer acquisition costs (CAC) and elevating conversion rates. This model not only facilitates affordable monthly installments for annual contracts but also ensures vendors receive the contract’s full value upfront. It mirrors the consumer BNPL model's risk mitigation by conducting thorough credit and identity verifications, thereby relieving vendors of collection and billing concerns.

Balance Sheet Optimization with BNPL

Implementing BNPL can significantly boost financial agility and growth potential for SaaS enterprises. It enhances deal conversion rates, minimizes sales cycle durations, and alleviates the sales team's workload in managing payment plans or interest calculations. Moreover, it fosters recurring renewals, reduces churn, and maximizes customer lifetime value (LTV). By preserving buyers’ cash reserves and expanding their purchasing power without hitting credit limits, BNPL paves the way for seizing new market opportunities swiftly and capitalizing on time-sensitive technological advancements.

Streamlining Sales with B2B BNPL

BNPL for B2B can revolutionize the cash flow management for businesses, making high-ticket items more affordable and accelerating deal closures. It offers financing for the entire contract value, allowing vendors immediate payment while buyers enjoy the flexibility of installment payments. This accessibility boosts annual contract uptake and facilitates the acquisition of significant software tools or services.

Enhancing Valuations through BNPL

BNPL for B2B not only promises higher average contract values and reduced sales cycles but also grants SaaS companies considerable financial leverage and growth advantages. It allows buyers to defer payments, offering vendors revenue based financing without incurring debt or allocating resources to chase payments. Furthermore, by eliminating the need for traditional credit or loans, BNPL opens new customer segments, enhancing vendor valuations and fostering stronger buyer relationships.

Customer Case Story: Splunk's Journey with BNPL

In the competitive landscape of SaaS, innovative financing solutions like BNPL (Buy Now, Pay Later) for B2B have emerged as game-changers. A standout example of the transformative power of BNPL is seen in the journey of Splunk, a leader in data-to-everything platforms. Under the leadership of Doug Merritt, the former CEO, Splunk leveraged Ratio's BNPL solutions to unlock unprecedented sales acceleration and growth financing that, according to Merritt, was once a privilege reserved for only the largest corporations in the world.

Challenge: Expanding Market Reach and Sales Velocity

Splunk, with its sophisticated software solutions, faced the challenge of making its offerings more accessible to a broader range of businesses, including small and mid-sized enterprises that could benefit significantly from their data analytics capabilities. The traditional sales model, reliant on upfront payments, often posed a significant barrier to closing deals, especially with clients cautious about making large investments without immediate returns.

Solution: Embracing BNPL for Strategic Growth

Recognizing the need for a more flexible financing option, Splunk partnered with Ratio to implement a BNPL solution tailored for the B2B market. This strategic move was aimed at dismantling the upfront payment barrier, thus enabling more clients to adopt Splunk's technology without the immediate financial strain.

Impact: Accelerated Sales and Enhanced Financial Flexibility

The adoption of Ratio's BNPL solution had a profound impact on Splunk's sales strategy and overall growth. Doug Merritt highlighted the "powerful, often untapped strategy" that BNPL presented for SaaS companies looking to accelerate their sales and access growth financing. With the ability to offer their solutions on a pay-later model, Splunk experienced a significant uptick in deal closures, particularly among small and mid-sized businesses that previously hesitated due to cost concerns.

By allowing clients to spread the cost of their investment over time, Splunk not only removed a major sales obstacle but also enhanced client satisfaction and loyalty. The financial flexibility offered by BNPL enabled Splunk's clients to manage their cash flow more effectively, invest in other critical areas of their business, and realize the value of Splunk's offerings without the immediate financial burden.

Looking Forward: A Paradigm Shift in SaaS Financing

Splunk's success story with BNPL is indicative of a broader trend in the SaaS industry, where flexible financing options are becoming critical to unlocking sales potential and fostering long-term growth. Doug Merritt's endorsement of Ratio's BNPL solution underscores the strategic advantage it provides, not just for large enterprises but for businesses of all sizes seeking to leverage technology for competitive gain.

As more companies recognize the benefits of BNPL for B2B, we're likely to see a paradigm shift in how SaaS solutions are financed and sold. Splunk's journey with BNPL offers a compelling case for the transformative impact of innovative financing solutions on sales acceleration, client acquisition, and overall business growth.

Discover how BNPL (Buy Now, Pay Later) for B2B transforms the financial landscape for SaaS companies. By offering customers flexible payment installments, BNPL solutions not only enhance cash flow but also simplify the quote-to-cash journey, significantly reducing the time spent on credit checks and fraud screening. This accelerates deal closures and increases total contract value…

Recent Posts

- Expert Cleaners Lexington Shares Essential Tips for Properly Cleaning Hardwood Floors

- Affordable Fencing Solutions: Fence Company Rochester NY Offers Insight on the Cheapest Fence Installations in Rochester, NY

- Exploring the Drawbacks of Duct Cleaning: Insights from Air Vent Cleaning Charlotte

- Exploring the Drawbacks of Duct Cleaning: Insights from Air Vent Cleaning Charlotte

- Clearing the Dust: Duct Cleaning Louisville KY Shares Tips to Make Your Home Less Dusty